Life Insurance in and around Bronx

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

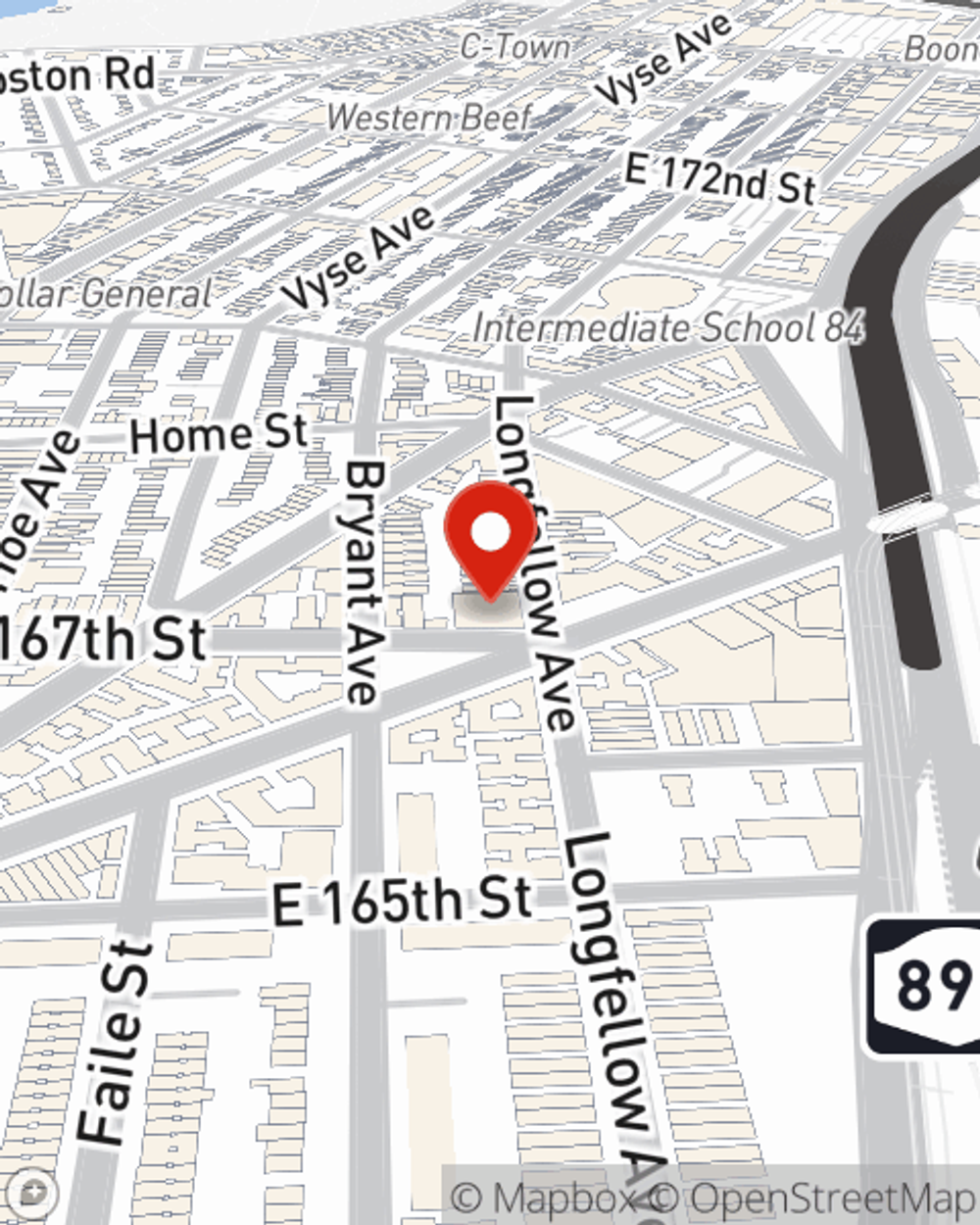

- BRONX

- MANHATTAN

- QUEENS

- BROOKLYN

- STATEN ISLAND

Your Life Insurance Search Is Over

State Farm understands your desire to cover the ones you hold dear after you pass away. That's why we offer great Life insurance coverage options and reliable caring service to help you opt for a policy that fits your needs.

Coverage for your loved ones' sake

Life happens. Don't wait.

Their Future Is Safe With State Farm

When it comes to opting for what type of policy is appropriate, State Farm can help. Agent Gladys Quinones can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include your age, your physical health, and sometimes even gender. By being aware of these elements, your agent can help make sure that you get a personalized policy for you and your loved ones based on your unique situation and needs.

Contact State Farm Agent Gladys Quinones today to find out how the leading provider of life insurance can protect your loved ones here in Bronx, NY.

Have More Questions About Life Insurance?

Call Gladys at (718) 484-3373 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Gladys Quinones

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.